Financial markets are characterized by high volatility, unpredictability, and the presence of extreme values or outliers. Accurate forecasting in such an environment is critical for investment decisions, risk management, and strategic planning. Traditional statistical and econometric models often underperform when confronted with noisy data or anomalies. Robust methods, which are designed to reduce the influence of outliers and handle irregularities, have become essential tools in financial forecasting. These techniques improve predictive accuracy, support more resilient decision-making, and provide reliable insights even under adverse market conditions.

Table of Contents

Understanding Robust Methods in Finance

Robust methods refer to statistical and computational approaches that maintain performance in the presence of data irregularities, including outliers, heavy tails, or missing values. In financial forecasting, such methods enable analysts to detect true market trends, minimize false signals, and construct resilient models for asset pricing, portfolio optimization, and risk assessment.

Key Components of Robust Methods

- Outlier Resistance: Techniques are designed to limit the influence of extreme data points, which may result from market anomalies or data errors.

- Adaptive Weighting: Assigning weights to observations based on reliability reduces the impact of unreliable or noisy data.

- Non-Parametric Approaches: Some robust methods do not assume specific distributions, making them suitable for financial datasets that are often non-normal or skewed.

- Resilient Model Estimation: Robust estimation procedures, such as M-estimators or Least Trimmed Squares (LTS), provide stable parameter estimates despite irregular data.

Applications of Robust Methods in Financial Forecasting

Robust techniques are widely applied across various aspects of financial forecasting:

| Application Area | Robust Method Used | Outcome |

|---|---|---|

| Stock Price Prediction | Robust regression, RANSAC | Accurate identification of trends despite market shocks |

| Portfolio Optimization | Robust covariance estimation | Minimizes risk exposure by accounting for extreme returns |

| Risk Management | Value at Risk (VaR) with robust estimation | Reliable assessment of potential losses under market stress |

| Financial Time Series Analysis | ARIMA with M-estimators | Stable trend and seasonal estimates despite anomalies |

| Fraud Detection | Robust clustering and anomaly detection | Detects unusual patterns and potential fraudulent transactions |

Techniques in Robust Financial Forecasting

- Robust Regression Models: Used to predict asset prices and returns while reducing sensitivity to outliers. Techniques include M-estimators, RANSAC (Random Sample Consensus), and Theil-Sen estimators.

- Robust Covariance Estimation: Helps construct portfolios that are less sensitive to extreme asset movements by estimating the covariance matrix using robust methods like Minimum Covariance Determinant (MCD).

- Robust Time Series Models: Time series techniques such as ARIMA or GARCH models can be modified with robust estimators to handle non-normal residuals and sudden market shocks.

- Non-Parametric Methods: Techniques like quantile regression allow modeling of conditional distributions of returns without assuming normality, making them ideal for capturing tail risks.

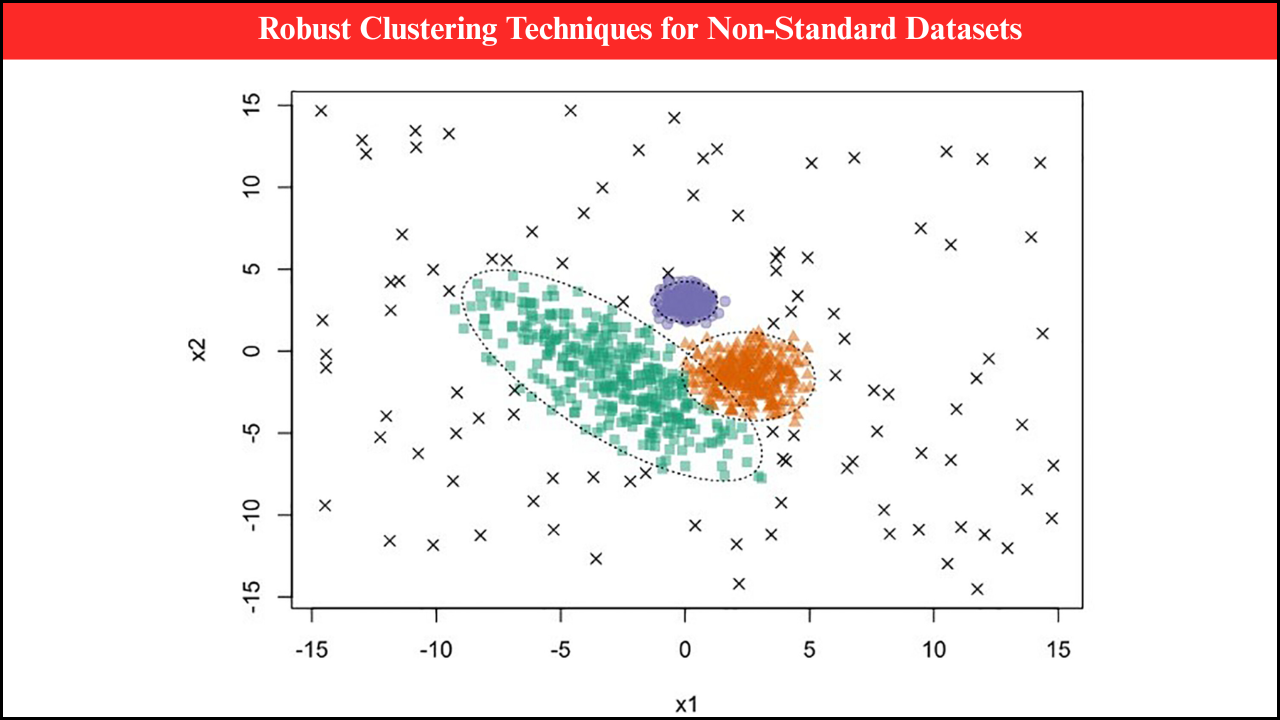

- Robust Clustering and Classification: Used for identifying patterns in financial data, including market segmentation, anomaly detection, and fraud detection. Methods like k-medoids or density-based clustering are less influenced by extreme observations.

Case Studies Demonstrating Robust Methods

| Case Study | Dataset | Method Used | Result |

|---|---|---|---|

| Stock Price Forecasting | Daily stock returns | RANSAC regression | Accurate trend estimation despite volatile days |

| Portfolio Risk Assessment | Equity portfolios | Robust covariance estimation | Reduced portfolio risk under extreme market conditions |

| Financial Time Series Analysis | Exchange rate data | ARIMA with M-estimators | Stable prediction of seasonal and trend components |

| Fraud Detection in Transactions | Credit card transaction dataset | Robust clustering | Detection of unusual transactions and anomalies |

| Extreme Market Events Modeling | S&P 500 daily returns | Robust GARCH | Reliable volatility modeling and stress scenario analysis |

Advantages of Robust Methods in Financial Forecasting

- Improved Predictive Accuracy: Reduces the influence of extreme values that can distort predictions.

- Resilience Against Market Shocks: Provides stable estimates even during periods of high volatility.

- Flexibility Across Financial Variables: Applicable to stock returns, exchange rates, bond yields, and derivatives.

- Better Risk Management: Facilitates accurate measurement of portfolio risk, Value at Risk (VaR), and extreme event probabilities.

Challenges in Applying Robust Methods

- Computational Complexity: Some robust techniques, particularly for large datasets, require significant computational resources.

- Model Selection: Choosing the most suitable robust method depends on dataset characteristics and forecasting objectives.

- Integration with Traditional Models: Combining robust methods with classical financial models or machine learning algorithms requires careful calibration and validation.

- Data Limitations: High-frequency or sparse financial data can limit the effectiveness of certain robust techniques.

Technological Tools Supporting Robust Financial Forecasting

- Statistical Software: R packages such as robustbase and MASS, Python libraries like statsmodels and scikit-learn, facilitate robust modeling.

- High-Performance Computing: Essential for processing large volumes of financial data and running robust simulations.

- Real-Time Data Feeds: Integration with live market data allows robust models to adapt to rapidly changing conditions.

- Machine Learning Integration: Combining robust statistical methods with machine learning models enhances predictive power and anomaly detection.

Future Directions in Robust Financial Forecasting

- Hybrid Approaches: Integrating robust statistics with AI and deep learning to improve forecasting under extreme market conditions.

- Adaptive Models: Real-time updating of robust models to reflect evolving market dynamics and reduce lag in response to shocks.

- Cross-Market Analysis: Applying robust methods across multiple financial markets and asset classes to capture systemic risk.

- Automated Risk Management: Using robust models for automated decision-making and algorithmic trading to mitigate risk exposure.

- Enhanced Visualization: Developing interactive dashboards that display robust forecasts, extreme event probabilities, and risk metrics for stakeholders.

Closing Reflections

Robust methods are indispensable for financial forecasting in today’s volatile markets. By reducing the influence of outliers, handling irregularities, and accommodating non-normal data distributions, these techniques provide more reliable insights for stock price prediction, portfolio optimization, risk management, and fraud detection. The application of robust methods enhances decision-making, supports resilient financial strategies, and improves risk assessment. With advancements in computational power, data availability, and hybrid modeling techniques, robust methods are set to play an increasingly central role in the future of financial forecasting.